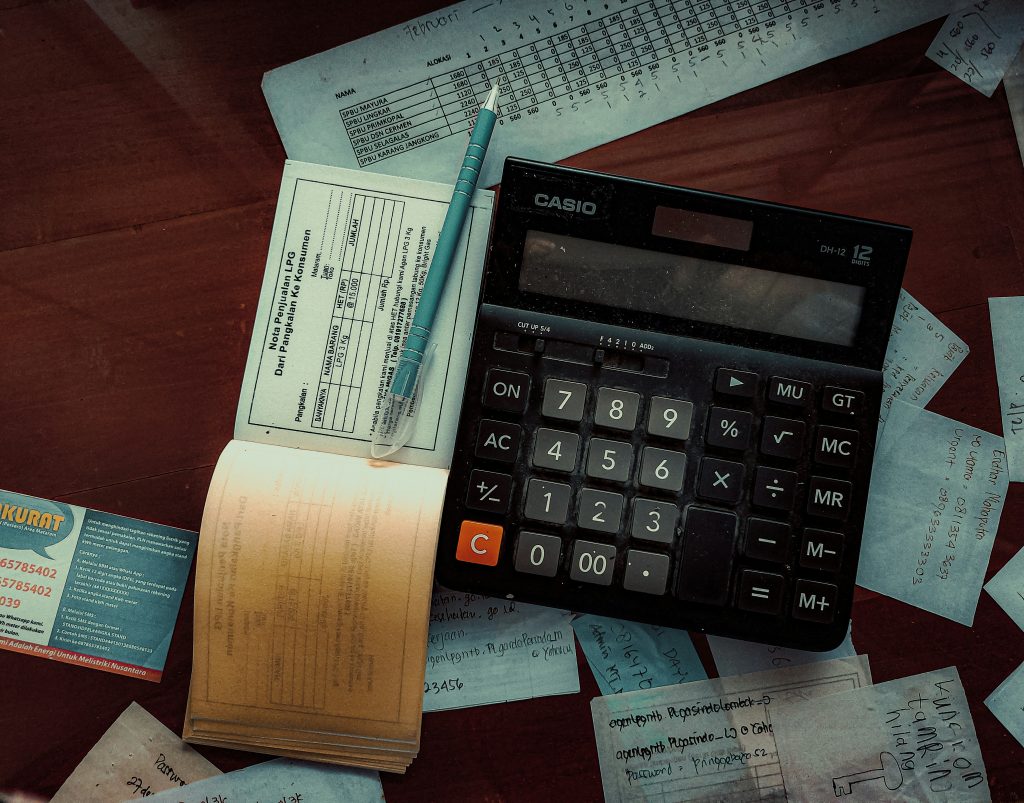

Financial and Accounting Tools for Fashion Businesses

Financial Management for Apparel

1 simplifies Financial Management for Apparel companies with a powerful ERP system that integrates seamless Inventory Management and accounting tools. Our solution is built to handle accounting, invoicing, and cost control across the entire apparel business, ensuring accuracy at every step. Whether you’re managing production costs, tracking vendor payments, or analyzing profitability, N41’s ERP platform combines Inventory Management and financial features to keep your business organized and efficient.

From small fashion startups to enterprise-level brands, N41’s ERP and Inventory Management system helps streamline operations, improve financial visibility, and optimize overall performance for apparel companies.

Optimize Inventory and Orders with N41 Apparel ERP. Schedule a Demo Today!

Learn how N41 Apparel ERP Software can help you save time and money while growing your business.

Comprehensive Guide to Financial and Accounting

Introduction to Financial and Accounting

Financial and accounting systems form the backbone of economic decision-making for businesses, organizations, and individuals. These disciplines involve the systematic recording, analyzing, and reporting of financial transactions and information to provide insights into financial performance and position.

Core Accounting Principles

The Accounting Equation

The foundation of accounting is based on the accounting equation: Assets = Liabilities + Equity

This equation must always balance and forms the basis of the double-entry bookkeeping system.

Double-Entry Bookkeeping

Every financial transaction affects at least two accounts. For every debit entry, there must be a corresponding credit entry of equal value, ensuring the accounting equation remains balanced.

Accrual vs. Cash Accounting

- Accrual Accounting: Records revenues and expenses when they are earned or incurred, regardless of when cash is exchanged

- Cash Accounting: Records revenues and expenses only when cash is received or paid

Financial Statements

- Assets: Resources owned (cash, inventory, equipment, property)

- Liabilities: Obligations owed (loans, accounts payable)

- Equity: Ownership interest (assets minus liabilities)

- Revenue: Income from business activities

- Expenses: Costs incurred to generate revenue

- Net Income/Loss: Revenue minus expenses

- Operating Activities: Cash from core business operations

- Investing Activities: Cash from buying/selling assets

- Financing Activities: Cash from debt and equity financing

- Beginning equity balance

- Net income/loss

- Dividends or distributions

- Additional investments

Types of Accounting

- Focuses on preparing standardized reports for external stakeholders

- Follows strict guidelines (GAAP, IFRS)

- Emphasizes historical financial information

- Provides information for internal decision-making

- Not governed by strict reporting standards

- Forward-looking and includes forecasting

- Focuses on segment reporting and cost analysis

- Focuses on tax compliance and planning

- Follows tax laws and regulations

- May differ from financial accounting methods

- Independent examination of financial statements

- Verifies accuracy and compliance with standards

- Internal audits (for management) vs. external audits (for regulators/investors)

Financial Management Concepts

N41’s reporting capabilities provide deep insights into your inventory operations through a variety of pre-configured and customizable reports.

While there are “thousands of preset reports in N41” and it “may be very time consuming” to find the right ones initially, users confirm that “once you have your favorites ready, your life will get a whole lot easier/faster.” Capterra

Our reporting suite includes:

Inventory Performance Reports

Detailed analyses of inventory metrics such as turnover rates, days on hand, and carrying costs, broken down by product category, collection, or other relevant dimensions.

Sales Analysis Reports

In-depth examinations of sales data, including top-selling products, sales by channel, and comparative analyses across time periods.

Forecasting and Planning Reports

Tools for predicting future inventory needs based on historical data, seasonal patterns, and current trends, aiding in more accurate purchasing decisions.

Operational Efficiency Reports

Metrics related to order processing times, fulfillment rates, and other operational factors that impact overall business performance.

Regulatory Framework

- Standard accounting rules for U.S. companies

- Established by the Financial Accounting Standards Board (FASB)

- Global accounting standards adopted by many countries

- Established by the International Accounting Standards Board (IASB)

- U.S. legislation enhancing corporate governance and financial disclosure

- Established in response to major accounting scandals

Accounting Technology

- Basic bookkeeping software

- Enterprise Resource Planning (ERP) systems

- Cloud-based accounting solutions

- Artificial Intelligence in accounting

- Blockchain for financial records

- Robotic Process Automation (RPA)

Careers in Finance and Accounting

Professional Certifications

- Certified Public Accountant (CPA)

- Chartered Financial Analyst (CFA)

- Certified Management Accountant (CMA)

- Chartered Global Management Accountant (CGMA)

Career Paths

- Public Accounting

- Corporate Finance

- Financial Planning

- Investment Banking

- Risk Management

- Auditing

Conclusion

Financial and accounting knowledge is essential for making informed business decisions, meeting regulatory requirements, and ensuring long-term financial health. Understanding these concepts provides stakeholders with the information needed to evaluate performance, assess risks, and plan for future growth.